International

In our globalised world, companies’ activities often transcend national borders. Subsidiaries and/or branches abroad or established in Switzerland need to be covered correctly in coordination with existing insurance plans. We meet these needs and support you in establishing an international insurance solution.

Furthermore, international companies who want to set up in Switzerland oftentimes are not familiar with our legal system and framework. In these cases, we act as bridge builders to help the persons responsible in your company to understand these matters and to develop the ideal solution for your Swiss branch. We are also happy to coordinate insurance plans with existing international insurance programmes and to support you in establishing international insurance solutions.

As a member of the WillisTowersWatson Network (WTWN), we are in a position to offer our clients operating internationally a broad range of services and solutions.

Important questions

How should we insure our newly founded subsidiary/branch abroad?

Can insurance plans abroad be coordinated with our Swiss insurance structure?

What insurance can we take out in Switzerland and what do we need to take out directly in the relevant country?

With which brokers abroad can we collaborate?

What legal requirements do we need to observe in Switzerland and abroad?

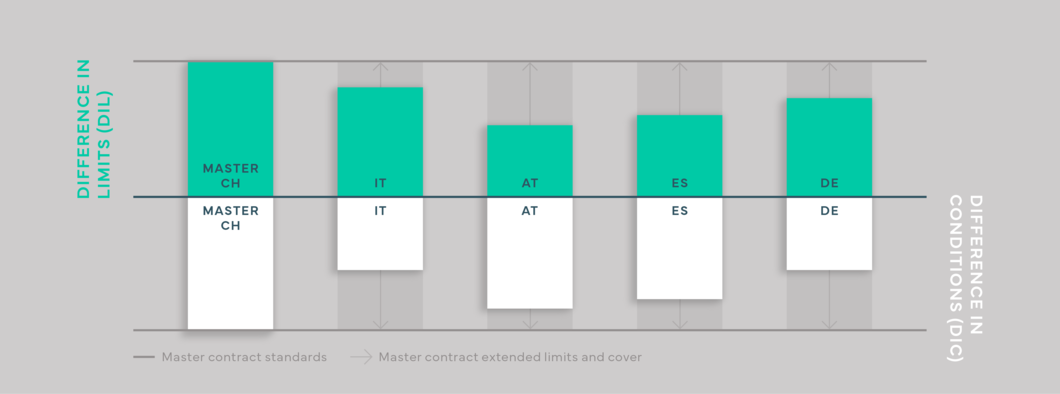

Concept for an international insurance programme

By implementing an international insurance programme, we can complement different local policies. This also enables you to match the insurance totals, coverage and conditions of your foreign policies with the level of your Swiss insurance plans. You can also make savings because you need to take out only minimal cover in the respective countries to meet local statutory requirements. This allows you to cover your risks abroad in a coordinated manner from Switzerland.

Your benefits

Development of international insurance and occupational benefits programmes

Tailored wording in various insurance sectors

Specialist consultancy regarding local and global risks in more than 140 countries

Support from roughly 40,000 experts from the WTW Network

International claims support

Compilation of insurance manuals and benefit overviews

Compilation of insurance reports

Support with implementing captive solutions